georgia film tax credit broker

Usually a broker puts buyers and sellers together. The Act incentivizes production companies to locate their production activities in Georgia by offering a transferrable entertainment tax credit to the production company up to 30 of.

Buyers Os State Film Tax Credits

Once purchased film credits may not be resold.

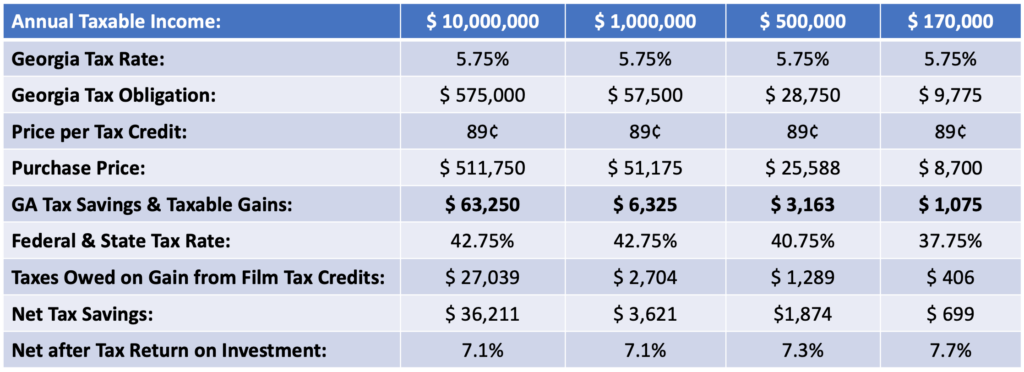

. With 975 million in film tax credits in the US resulting in over 100 films and thousands of jobs let our experience get. In fiscal 2019 Georgia film and TV spending reached 29 billion for the year. A Georgia taxpayer may purchase Georgia Entertainment Credits generally for around 88 per credit and apply them to their current year or future tax returns.

Purchasing Georgia film credits through an experienced and reputable broker such as Monarch Private Capital is highly recommended to make the process of buyer film credits as easy as possible. Additionally Monarch has tax credit directors. Monarch is the largest broker of Georgia film tax credits and one of the largest if not the largest broker of film tax credits across the United States.

They get an additional 10 for providing that cool Georgia Peach logo at the end of the. How-To Directions for Film Tax Credit Withholding. Pricing varies based on market circumstances.

Sugar Creek Capital facilitates the connections that maximize the value of Georgias film and entertainment state tax credit for film producers and investors. Film Incentives Group LLC is a national strategic consultancy and brokerage firm dedicated to helping corporate entities and individual taxpayers take full advantage of the many state tax credits that are available throughout the USA. We broker the sale of Georgia state entertainment tax credits from production company to the end taxpayer which allows for the monetization of the tax credits for the production company and tax savings for the taxpayer.

Tax The Georgia film credit can offset Georgia state income tax. Offset up to 100 Corporate Income Tax 100 Personal Income Tax. Offering the most completive pricing in the industry Film Incentives Group will maximize your tax savings when you purchase credits.

The buyers of film credits are taxpayers with a Georgia income tax liability. Qualifying Projects 20 tax credit is provided for companies that spend 500K or more on production and post production in Georgia. Register for a Withholding Film Tax Account.

The report revealed the use of inadequate procedures by the Georgia. Paying less on Georgia income tax. Includes a promotional logo provided by the state.

Louis and Springfield Missouri. Connecting production studios and investors with the benefits of state tax credits. The Georgia Department of Economic Development GDEcD is the governing body that certifies projects which qualify for the film tax incentive.

This discount represents the savings to a. The credit applies to pre-production production and post-production activities in Georgia. Getting a state tax deduction on Schedule A of your Form 1040 for the.

May offset 100 of a taxpayers liability. Georgia Film Tax Credits were created to entice production companies to come to Georgia and spend their money on movies films commercials etc. Heres how Film Tax Credits work.

Claim Withholding reported on the G2-FP and the G2-FL. Production companies generate the credit by spending money in Georgia on production activities. How to File a Withholding Film Tax Return.

Over the past several years Georgia has grown to become one of the top states in the country for film production largely as a result of the Georgia Film Television and Digital Entertainment Tax Credit. Big Changes Ahead for Georgia Entertainment Tax Credit. The most common entertainment tax credits that we broker are Georgia film tax credits.

The Tax Credit Services team manages Stonehenges state transferable film entertainment credit investments. We broker the sale of state entertainment tax credits from film production studios to taxpayers so both buyer and seller leave satisfied. Enter the Credit Details Enter the Broker Contact Information if applicable.

Film credits are not issued for the cost of a script. A Georgia film tax credit is a financial incentive that encourages production companies to film in Georgia by providing them with savings or tax benefits. If you would like additional information on how the Georgia Film Tax Credits can work for your specific situation give us a call at 678 804-4011 or send an email to infongasus.

On average 1 of Georgia Film Tax credit can be purchased for 087 to 090. Instructions for Production Companies. An additional 10 credit can be obtained if the finished project.

Otherwise fill out the form below and we will follow up with specifics to your situation. Since 2002 Stonehenge has monetized over 1 billion of film television and digital animation tax credits in 12 states making Stonehenge a trusted partner in. DOR and have a Georgia Tax Center GTC logon.

Third Party Bulk Filers add Access to a Withholding Film Tax Account. The Strategic Group is an experienced and trusted partner in Georgia entertainment tax credits with relationships with some of the largest productions groups in the state. According to the Motion Picture Association of America the Georgia film and TV industry created more than 92000 jobs as of mid-2018 representing nearly 46 billion in wages.

Monarch Private Capital is headquartered in Atlanta and has regional offices in Charlotte Sarasota St. Entertainment Film Credits. Please contact us if you would like more information on pricing or our process.

1037 was drafted in response to a report released earlier this year by the Georgia Department of Audits and Accounts DOAA. The broadening of this legislation permits a Georgia corporate fiduciary or individual taxpayer to purchase these credits to offset their Georgia income tax liability. There are three main benefits for purchasing Georgia Entertainment Credits.

House Bill 1037 HB. The way it works is that production companies get a 20 credit on what they spend for certain expenses while making their project. Film credits offset any taxpayers Georgia income tax liability.

Excess credits carry forward for five years. The Georgia Department of Revenue. The Georgia film tax credit program has generated more than 4 billion tax credits since the programs inception.

Unused credits carryover for five years. Currently extended to January 1 2019 Georgia allows for a 20 percent tax credit for companies that spend 500000 or more. We work with a diverse range of major studios and independent producers to help them secure state tax credits that fund up to 30 percent of.

As they may often not have income tax liabilities of their own these companies sell the credits to brokers who then resell them to Georgia taxpayers at a discount. Frazier Deeter. Film Tax Credit Electronic IT-TRANS Submission Outside of a GTC Login.

The Georgia attorney general s office has closed a criminal investigation into Warner Bros use of tax credits on the Clint Eastwood film. The State of Georgia implemented the Georgia Entertainment Industry Investment Act the Act in 2008. Georgias popular Film Tax Credit will undergo significant changes as of January 1 2021.

What is the Georgia film tax credit. The total credit with the Georgia logo is 30 percent of qualified production expenditures in Georgia.

Film Digital Media Tax Credits Clocktower Tax Credits Llc

Who We Are State Tax Incentives

Film Digital Media Tax Credits Clocktower Tax Credits Llc

Who We Are State Tax Incentives

Who We Are State Tax Incentives

Georgia Film Industry Leaders Believe Tax Incentives Are Crucial To Continued Success Atlanta Business Chronicle

With No Missouri Tax Incentives Filmmakers Go Elsewhere

Who We Are State Tax Incentives

Georgia Film Industry Leaders Believe Tax Incentives Are Crucial To Continued Success Atlanta Business Chronicle